Trusted Insurance

Life Insurance

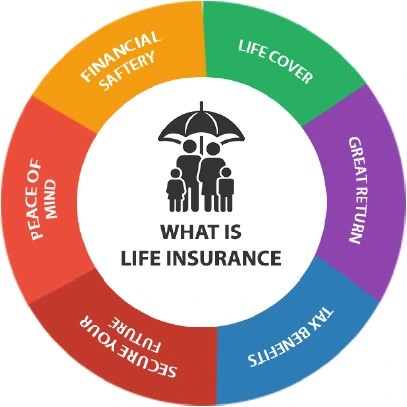

Life insurance is a type of insurance policy that provides a financial payout to beneficiaries upon the insured person’s death. It is meant to provide a source of financial support to the family or loved ones left behind after the insured’s death.

There are several types of life insurance policies, including term life insurance and Permanent life insurance. Term life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years, and pays out a death benefit if the insured person dies during that term. Permanent life insurance, on the other hand, provides coverage for the entire lifetime of the insured person and also has an investment component that builds cash value over time.

The cost of life insurance premiums depends on a variety of factors, including the age, health, and lifestyle of the insured person, as well as the amount of coverage and the length of the policy. It is important to carefully consider your financial needs and goals when choosing a life insurance policy and to regularly review and update your coverage as needed.

Life insurance can provide peace of mind, knowing that your loved ones will be financially protected in the event of your death. It can help cover funeral expenses, pay off debts, replace lost income, and provide for future expenses such as college tuition or mortgage payments.